car sales tax illinois vs wisconsin

If for example you pay a 10 sales tax on 20000 thats an additional 2000 you must spend not counting doc fees and DMV fees. If the vehicle that you purchased is used in your business and you deduct the sales tax on the business return possibly on Schedule C Form 1040 then you cannot deduct the sales tax on Schedule A Form 1040.

426 Hemi Custom Car Themed Guitar Custom Cars Custom Hemi

If you sell a vehicle to a customer who will title it in one of those states then you must charge the customer Illinois sales tax at the foreign states tax rate or at 625 whichever is less.

. Imagine that your monthly lease payment is 500 and your states sales tax on a leased car is 6. Why Ohio is one of the cheapest states to buy a car. Since the Missouri tax appears to be 4225 and the standard Illinois tax on vehicle sales is 625 you must pay the 2025 difference.

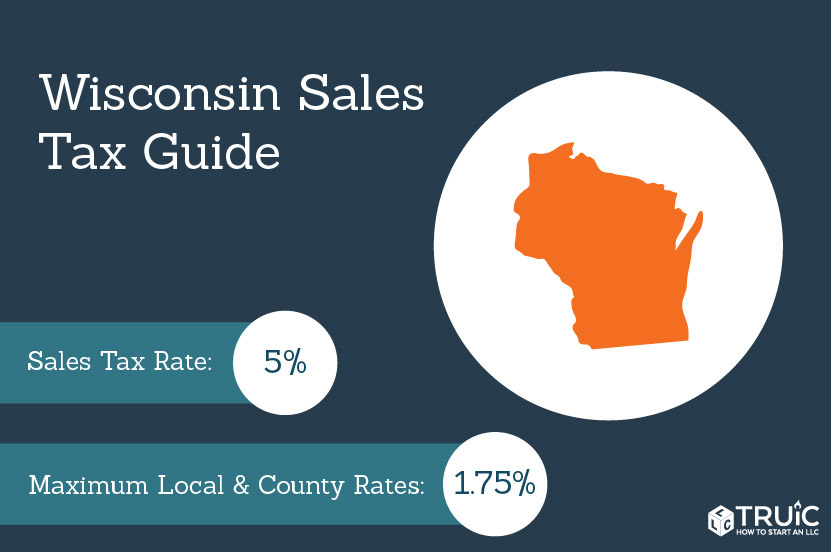

There is also between a 025 and 075 when it comes to county tax. Wisconsin gets the win here as both cities boast an average rent price just under 1000 per month based on numbers from. Sales tax for a leased vehicle is calculated based on the states tax percentage and the cost of the lease payments.

If you need to obtain the forms prior to registering the vehicle send us an email request or call our 24-hour Forms Order Line at 1 800 356-6302. Form RUT-50 Private Party Vehicle Use Tax Transaction Return. Car sales tax illinois vs wisconsin.

For example sales tax in Naperville is 775 and. Thats 2025 per 1000. Car tax as listed.

The information provided generally relates to the states 5 sales and use tax. Unless of course you reside in those Metro-East communities with a 65 tax on vehicle sales. If you had the vehicle titled in another state for more than three months no Illinois tax is due but you still must file Form RUT-50 to reflect that fact.

If you try to register the car in Illinois youll have to pay use tax at the time of registration on the difference between the sales tax paid to the state where you purchased and the Illinois rate generally 625 but higher in the collar counties. However the price of your rent changes dramatically given the neighborhood and desired amenities or if you want to add a bedroom roommate. The amount that you have to pay for your Illinois used car sales tax or your Illinois new car sales tax depends on what city you live in.

A motor vehicle purchased out of state and titled and registered in Wisconsin is subject to Wisconsin sales or use tax in the same manner as a vehicle purchased in Wisconsin unless an exemption applies. In addition to state and county tax the City of Chicago has a 125 sales tax. Wisconsin gets the win here as both cities boast an average rent price just under 1000 per month based on numbers from RENTCafe.

There is a limit of 10000 5000 if MFS on the amount of sales tax you can claim in 2018 to 2025. The taxes can be different in the case of a vehicle being purchased by a private party. 635 for vehicle 50k or less.

775 for vehicle over 50000. Madison - 980. Then the difference is.

Insurance premiums are the second lowest in the country. This reference is here to help answer your questions about what is and is not subject to the Wisconsin sales tax. Oak Brook Sales Tax.

However if a vehicle purchased in another state the District of Columbia or the Commonwealth of Puerto Rico is subject to sales tax in that. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate. Unless of course you reside in those Metro-East communities with a 65 tax on vehicle sales.

While its true that Illinoiss state sales tax of 625 is lower than Indianas state sales tax of 7 its also true that many cities and counties assess their. The state sales tax rate in illinois is 6250. 425 Motor Vehicle Document Fee.

A list of all the states for which you must collect sales tax and the rate you must charge can be found on the Illinois Department of Revenues website at. The taxability of various transactions like services and shipping can vary from state to state as do policies on subjects such as whether excise taxes or installation fees included in the purchase price are also subject sales tax. 500 X 06 30 which is.

Additionally sales tax varies from city to city in Illinois. Sales tax is charged on car purchases in most states in the US. In most states you pay sales tax on the monthly lease payment not the price of the car.

The taxes can be different in the case of a vehicle being purchased by a private. However in counties which have adopted the 05 county sales and use tax and counties where the 01 or 05 stadium tax is imposed the coun-ty tax and stadium tax may also apply to any transaction which is subject to the state tax. Illinois Tax Requirements for Vehicles.

New Updates to the Amount You Can Claim. Illinois collects a 725 state sales tax rate on the purchase of all vehicles. Arizona has the lowest registration fee of 8 but the state adds a 32 public safety fee.

Gas prices and maintenance fees are lower than most states. There also may be a documentary fee of 166 dollars at some dealerships. You must pay sales tax when you lease a car.

On Forms RUT-25 and RUT-50 the exemption for using the. Whether the car is purchased used or new. If you originally purchased or acquired by gift or transfer your vehicle from an individual or other private party you must use Form RUT-50 when you bring the vehicle into Illinois.

Form RUT-50 is generally obtained when you license and title your vehicle at the local drivers license facility or currency exchange. While you may be used to paying sales tax for most of your purchases the bill for sales tax on a vehicle can be shocking. Car sales tax rate is 575 which is slightly higher than other states.

What S The Car Sales Tax In Each State Find The Best Car Price

Wisconsin Vehicle Titles Kids Car Donations

Wisconsin Sales Tax Small Business Guide Truic

Free Wisconsin Vehicle Bill Of Sale Form Pdf Formspal

Wisconsin Car Registration Everything You Need To Know

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

Free Wisconsin Motor Vehicle Bill Of Sale Pdf Eforms

Car Tax By State Usa Manual Car Sales Tax Calculator

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Cost Of Registering A Car In Wisconsin Is Going Up Title Fees Too

Schellinger Custom Pontiac Firebird Car Themed Guitar Firebird Car Pontiac Firebird Guitar

California Has Trillions More Wealth Than Any Other State California New Hampshire Maryland

Car Tax By State Usa Manual Car Sales Tax Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Wisconsin Car Registration Everything You Need To Know

Free Wisconsin Dmv Vehicle Bill Of Sale Form Pdf Word Doc

Schellinger Custom Msiii Guitar 2017 Quilted Ash Top Rosewood Back Custom Guitar Custom Guitars